what is fsa health care contribution

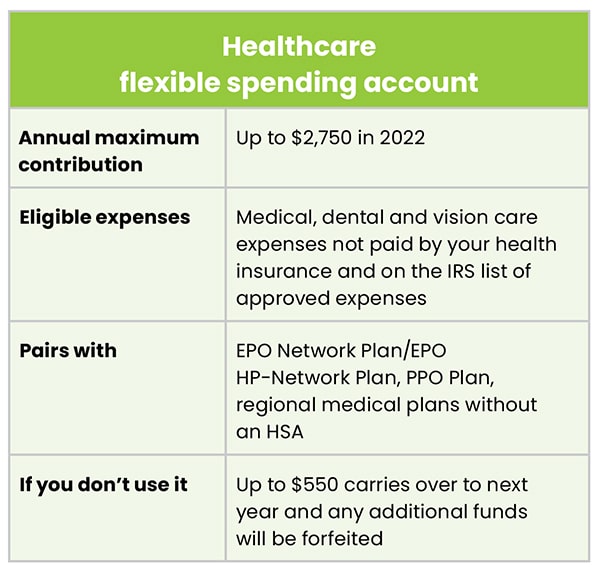

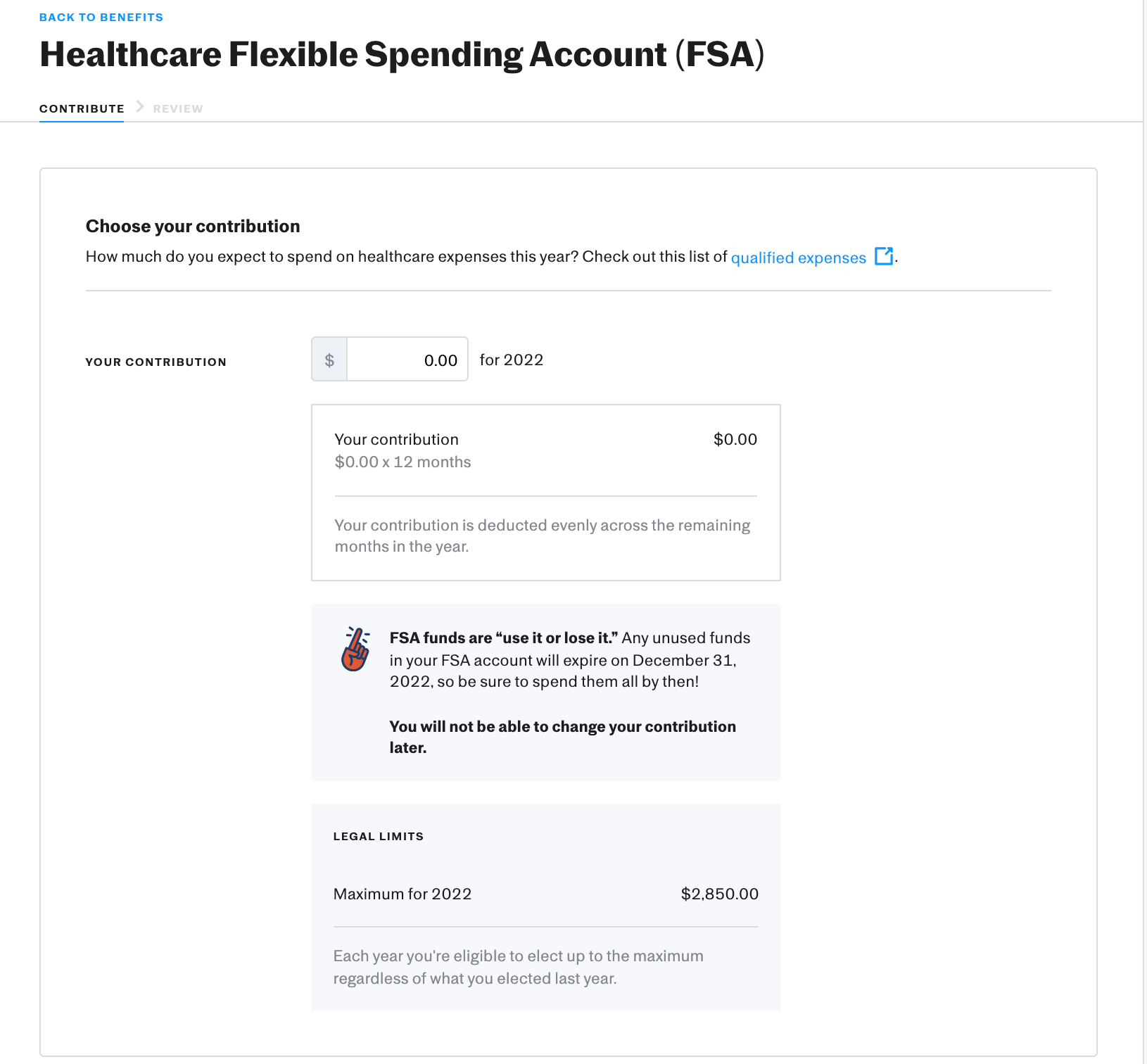

The contribution limits on dependent care FSAs are also higher. Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850.

Fsa Vs Hra Vs Hsa An Explanation With Comparison Chart

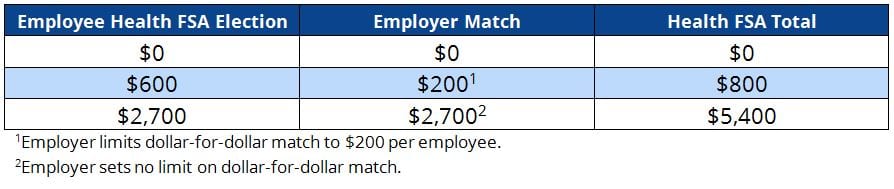

An employer may match up to 500 whether or not the employee.

. Second your employers contributions wont count toward your annual FSA contribution limits. Note if your and your spouses employers both offer an FSA you may each be able to set up your own account and contribute up to the maximum amount each. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

As a result the IRS has revised contribution limits for 2022. Here are the maximum. The money employees contribute to an HSA can go toward healthcare expenses as well as investments like stocks or bonds.

There are a few things to remember when it. A health care FSA is. The IRS puts a limit on an employers contribution to the Health FSA based on how much the employee contributes.

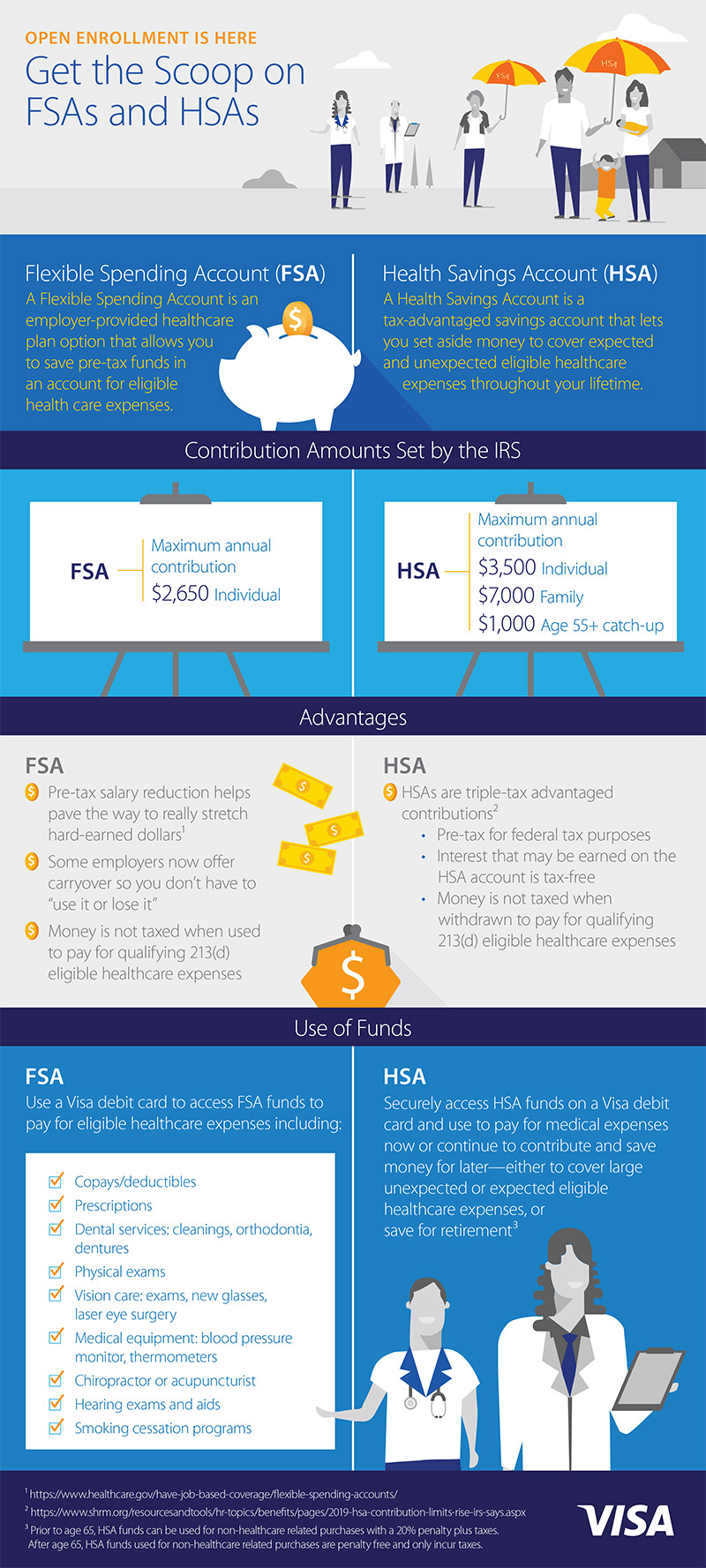

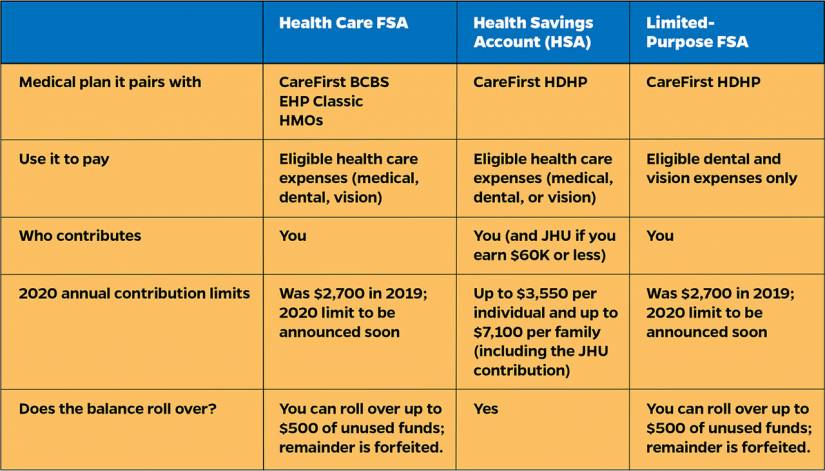

What is a health care FSA. To sign up for an HSA you also must be enrolled in a high-deductible health plan. 8 You can use the funds in your FSA to pay for qualified medical or dependent-care expenses.

An FSA is a financial account that employees can fund with pretax contributions. Typically the contribution limit is 5000 for married couples filing jointly and 2500 for single filers. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year.

A flexible spending account FSA is a type of savings account usually for healthcare expenses that sets aside funds for later use. 10 as the annual contribution limit rises to. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

For example if your employer put in 300 and you decided to contribute 600 you have 900 to. For 2021 the contribution limit for a dependent-care FSA is 10500 for joint and individual tax returns and 5250 for married taxpayers filing separatelyan increase given. Plus if you re.

For calendar year 2021 the dependent care flexible spending account FSA pretax contribution limit increasesto 10500 up from 5000 for single taxpayers and married. A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses. There are different contribution limits as well with.

When you have a health or limited-purpose FSA the total amount is available on the first day. The annual contribution limit is 3650 for an individual or 7300 per family. Basic Healthcare FSA Rules.

More What Is a Health Savings. For example if you earn 45000 per year. You also learn how much you could save on taxes.

You can contribute up to 2850 in 2022 but you can adjust your amount only during open enrollment or if you have a qualifying event such as getting married or having a. Employers may make contributions to your FSA but arent required toA Flexible Spending Account also known as a flexible spending arrangement is a special account you put money. This pre-tax benefit account helps you save on eligible out-of-pocket dental and vision care expenses while taking advantage of the long-term savings power of an HSA.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. If youre planning your tax-sheltered income for 2021 the IRS did not increase the 2750 limit you can contribute to a health Flexible Spending Account FSA. General health care FSA questions Here are answers to some commonly asked questions about health care flexible spending accounts FSAs.

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

Does Money In A Flexible Spending Account Fsa Roll Over

Hra Vs Fsa See The Benefits Of Each Wex Inc

Will My Flexible Spending Account Show Up On A W 2

What To Know About Spending Accounts For 2020 Hub

Healthcare Flexible Spending Account My Aci Benefits

Flexible Spending Accounts Healthcare Fsa Dependent Care Fsa Justworks Help Center

Can Employers Add To Employee Health Fsa Contribution Core Documents

What Is An Fsa Definition Eligible Expenses More

Flexible Spending Accounts Fsa Via Optum Financial Justworks Help Center

Flexible Spending Accounts Fsa Isolved Benefit Services

Can Employers Add To Employee Health Fsa Contribution Core Documents

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

What Do I Need To Know About Fsas And Hsas One Medical

Using Bestflex Fsa Employee Benefits Corporation Third Party Benefits Administrator

What Is A Health Fsa And Why Is It So Important Lively

What Is An Fsa Your Guide To Flexible Spending Accounts

Flexible Spending Account Vs Health Savings Account Which Is Better